The technology giant has consistently generated a significant number of millionaires throughout its history. Is it poised to create even more in the future?

Microsoft (MSFT 1.22%) stock has turned many shareholders into millionaires over the past few decades. After all, the software giant’s climb toward $3 trillion of market capitalization has been fantastic, punctuated recently by its overtaking Apple as the world’s most valuable business. It pays well to be along for that kind of ride, even if you were relatively late to the growth party.

The software program massive’s enterprise looks a whole lot exclusive today than it did 25 years ago, and tech tendencies will in reality change many extra times over the subsequent several a long time. Yet, the large question for investors going ahead is whether or not the stock can nonetheless produce marketplace-beating returns, given Microsoft’s lofty valuation perch today. Let’s examine the factors that could make this stock a high-quality force ultimately in your retirement portfolio.

Size and Diversity

While investors can’t know which tech trends will dominate the industry in several years, they can feel reasonably confident that Microsoft will continue to be a leading player as those trends emerge. It already has excellent exposure to many growth niches, including cloud enterprise services, video games, cybersecurity, and artificial intelligence. That diversity also boosts its value to large customers, who are increasingly looking for a comprehensive software solutions provider.

Resources Matter

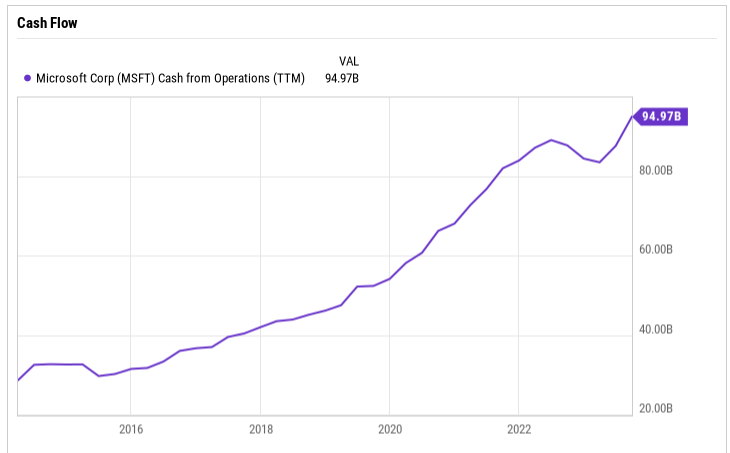

Microsoft’s financial strength is another huge factor in its favor. The company is sitting on over $140 billion of cash as of late September. It generated $30 billion of operating cash flow in just the last quarter, too, as operating profit jumped a healthy 26% higher year-over-year.

Microsoft’s substantial financial resources provide resilience in market downturns, enabling aggressive investments in tech innovations like AI. The ample cash allows for strategic acquisitions or partnerships, ensuring leadership in the evolving computing landscape—a flexibility rare among most tech companie.

Price and Value

As anticipated, Microsoft’s stock carries a premium, trading at over 13 times annual sales—a level not far from the pandemic peak in early 2022. In contrast, Amazon offers a more affordable option at around 3 times revenue, albeit with less lucrative profit margins compared to Microsoft.

Despite Microsoft’s elevated valuation and market cap, its stock could play a beneficial role in a retirement portfolio targeting a $1 million goal. Positioned to lead upcoming tech shifts and leveraging its entrenched status in the global software industry, Microsoft has the potential to create more millionaire shareholders in the decades ahead.